Talking of tying shoes I’ve always got this sneaking suspicion I’m doing it wrong. My laces never quite look right but I’ve never managed to find another way that isn’t worse. I use the “bunny ears” method as learned as a kid.

Haha!

‘Rabbit pops up out of his hole, runs round a tree and goes back down’ for me.

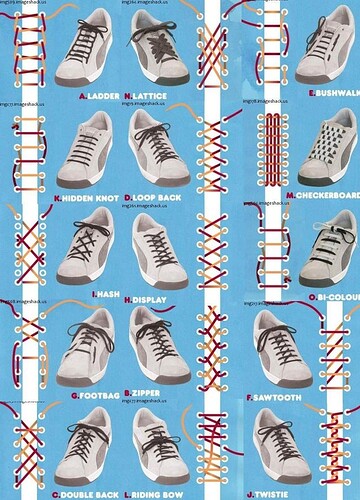

Which reminds me that I downloaded this many moons ago to forget about until this moment…

I’m rewatching a film called Predestination starring Ethan Hawk and Sara Snook (great sci fi if you haven’t seen it). Hadn’t checked my phone for a while so I opened Instagram and literally the first advert I saw was for a play starring Sara Snook…

Goddamn Bezos always listening

That film requires far too much suspense of disbelief for it to work.

Just watched Welcome to Hell, just because, nostalgia etc

Noticed a few instances of that ‘Modern’ filming technique. Seems it’s all been done before.

My crystal ball is telling me that @Mark probably has some really good advice on which home budget management app is the best.

Am I mystic Meg?

Depends exactly what your use case is…!

I went massively into this a few years back with the intention of automating importing transactions from my accounts and credit cards leveraging some new EU directive about Open Banking (but unfortunately a lot of banks are a bit slow on the takeup of this).

I’m Android, wife Apple and I wanted a desktop client as well. So that’s 3 separate platforms. And you’d be surprised how few apps support this.

Anyway, I seem to remember narrowing it down to YNAB (You Need A Budget) and Spendee.

Here’s my advice:

- Definitely get one where you import from your bank/credit cards and make sure they are compatible beforehand (I think these apps are american and patchy on support iirc). Manually entering all your transactions is a nause

- I would loosely test out both apps with you and your other half (if you are going in with her) as if it’s not easy to enter transactions you won’t (if you are doing it with your partner of course)

- If you are both doing it you both got to be full on into it otherwise the person entering all the transactions will be pissed off with the other that can’t be bothered

- The same with the reporting - it’s no good putting all the effort in to capture the data if you don’t know what you want to know about your spending habits

- Make sure you both agree what categories everything goes in. It’s a lot at first then rapidly reduces as time passes and becomes easier. It stops things like you putting petrol under ‘transportation’ and then wife creating new category called ‘petrol’ and subcategory called ‘Esso’ etc

- Put a weekly/monthly catchup/review together to go over everything

- Try to add your spending in daily or a couple days after as it’s difficult to remember what you spent money on and when

- Don’t get arsey about the app not being free, paying for the app actually helps you take the whole thing seriously

- You are mystic meg

iirc it was really difficult for us as very few apps support the banks we use because they are small Estonian institutions. Is easier if they are UK banks.

This is exactly what we don’t do and exactly why we have no money!

I knew full well I was getting a bullet point breakdown when I sent that message.

What can spanky NOT do?

Much appreciated and big thanks for taking the time out your day to come back with a detailed response. Wasc

Edit- use: collectively should be relatively well off but always end the month broke- want to work out where it’s all trickling away too

I may not have any disposable income but at least I’m not having weekly catch up meetings with my wife ![]()

There is very little by way of a good, recognised personal finance app/software for people in the UK in my opinion. Everything is so fragmented and support is so shite.

Last one I used to use was Microsoft Money 2001 and after a quick search people are STILL using it

Maybe I should set up a side hustle doing this. Whatever I have no idea where to start

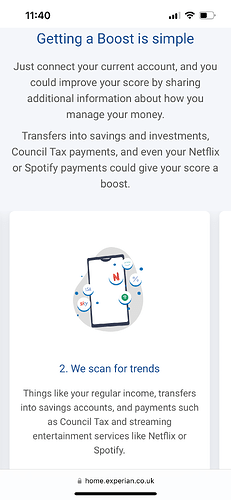

Experian have the means to tap into your Bank account(s) in order to generate credit rating improvements (if possible) based off monthly ‘commitments’ that you’re meeting via direct debit. I wouldn’t want them looking at mine lol

So there is a mechanism out there is what I mean. I’d want it private and tbh I’m not sure I’d trust a smaller start up with read access to my finances. Online bank statements aren’t too bad, but with a couple of accounts it is a ballache

Don’t they just have access to the same info used for credit scoring? i.e. they can see it whether you like it or not.

Nah, it’s actual access to your bank account and daily spending. Additional sign up.

Edit - Experian Boost. Trend scanner in a nutshell.

What do you need a good credit score for? Just to borrow more money? Do you get better rates for a good score or are you just more likely to be approved. I’m nearly 40 and I know nothing about money.

The more credit you are managing, the more they will give you. As long as you’re managing it. The less you have, the less they want to give you… or something like that I think.

I try to stay away from using it where possible.

Yep, perverse isn’t it haha. It’s basically a history of you paying back like a Lannister.

I don’t mind, I’ll use it if I deem it worthwhile and don’t have an issue with borrowing if need be.

I went from 200 to 999 on experien in 3 years when I stopped gambling and cleared the defaults. Having good credit is so helpful. Bad credit makes you poorer because of interest rates, it’s very hard to get out of but can be done.

I’ve got bad credit but had no idea until I tried to get a British Gas account and they refused me for having no credit history.

I’m proud of never having owned a credit card or taken a loan (other than mortgage).

It’s a fucked up situation and I was genuinely angry that Experian was able to access my personal information and make a call on my ability to pay a fucking gas bill.

I used Moneywiz for a few years. Just going to add to Spanky’s pretty much complete list there - some apps will let you upload your statements as CSV files, which are a form of text document you can spit out from a spreadsheet or banking app. Personally, I’m not a fan of allowing any finance app to scrape banking data via the backdoor so uploading CSVs works / worked for me.