Yep my split is like 43% USA, 26% Uk, some in Europe and rest is round the world to try and avoid hot spots

Just came to say it pleases me that you guys are looking at funds and trackers rather than punting on stocks and crypto.

Just please don’t start a Mikey Taylor social media advice channel.

I put £100 into BitCoin and bailed when it dropped to £58. Missed the boat I think. I do know a guy who bought one for £200 a few years ago. Hope he kept it until the £50k peak.

I think you’re right.

When air travel in china opened back up, RR bumped as the engine service plan orders came in over night

I use Hargreaves Landsdown to buy shares although my money is in tracker funds and not stocks.

Make use of the stocks and shares ISA there if you don’t currently have one. £20k tax free investing.

I use Vanguard for a market tracking ISA. Although I managed to open it just before Covid and Ukraine and have so far lost 6% of my money ![]() . That said the fund had annual returns for the 5 years before that of between 5 and 13% so I’m sitting tight for a recovery

. That said the fund had annual returns for the 5 years before that of between 5 and 13% so I’m sitting tight for a recovery

I stick the child benefits into one of these - Digital Regular Saver | Regular Savings Account | NatWest

Not checked Vanguard in a while need to get back on it

Just work it out - how many bikes do you have to park up and at what price to make the economics work? A quick Google says Brussels has some of the highest per square metre rental costs in Europe at between 160-300 euros per square metre.

How many bikes can you store in a square metre? Assuming no stacking system, 3 bikes every 2 square metres?

So lets go middle of that price range - 220 euros. Double it for 2 square metres, that’s 440 euros a month you need to earn from the space just to pay the rent.

Add insurance, staff, rates, advertising, etc… and it’s gonna be maybe 480? Divide 480 by 3 and each space has to earn 160 a month rental fees to break even.

So I suggest charge of around €10 a day might make this business profitable. If you think people could stomach that it might work.

However, another quick Google suggests that therte’s already a government sponsored secure cycle parking system that charges just €15 a YEAR so the idea is a non-starter.

Everything starts with an idea!

Bumping this one, where’s good to put money these days?

I’ve got the below Vanguard bits so guess just top them up unless anyone has some dope get mega rich quick schemes I should know about ![]()

LifeStrategy® 80% Equity Fund - Accumulation

S&P 500 UCITS ETF - Distributing (VUSA)

Stocks & Shares ISA - ftse global all cap

About to get a nice bit of cash from selling a rental property that I got for inlaws who are now moving away and trying not to spunk it all really

I’m just finishing a book called Simple Path To Wealth by this guy in America who was one of the original save-invest-retire-early gurus and he presents a really good case for just shoving as much money, as early as you can and as for as long as you can, into a fund that tracks the stock market. The compound interest effect is mental when you work it out. Like if you’re lucky enough to be able to be really frugal and shove something like a grand a month away into these things for 20 years you could easy have a million at the end. So starting in your 40’s you’re lotto winner by retirement age.

Likely he didn’t. Some smug mfs when it was high have gone a bit quiet about it since that first big drop

(Re bitcoin and selling high)

I like the idea of investing in art and rarities so you can have it on your wall for 20 years but I’m too much of a wuss to do it really and I haven’t got much spare anyway

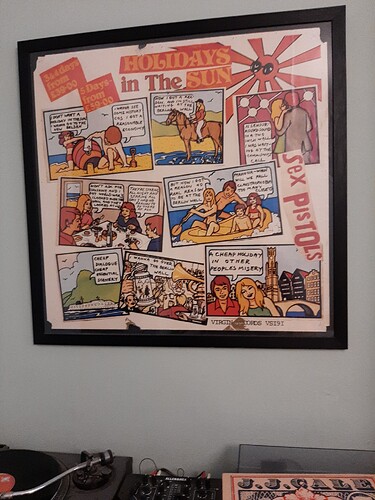

That said I bought one like this framed when I was feeling flush a few years ago for £350. It’s an original, bit tatty round the edges but looks good like that. Jamie reid has died since and the prices have gone up if you believe this valuation

I’m in agreement with @ParmoViolets, over the years FTSE trackers give about 10%, compound that over a decade or two and you’re quids in without too much risk. Sounds like your current fund selection is spot on. If you get a nice little bump from that property sale I’d top up your existing funds and maybe stick a bit in a more high risk fund to see what happens.

This guy is really good.

Really depends on what part of the equity curve you decide to retire at if you’re in index funds @OAS ! Real eye opener.

Saying that though I’m in on s&p/vanguard/Dax and defence indexes. AI and energy stocks.

Also interested to know this. Finding a job was a struggle this summer and with 40 heading over the hill soon I’m starting to think I need to make some financial moves for the future.

What’s a good long term, safe investment for someone who doesn’t know anything about investing? Stick £10k in a tracker and leave it for 20 years?

Bonds probably safest. Indices/etc if you want a bit more risk